ADA Price Prediction: Analyzing the Path to $1 Amid Technical and Fundamental Signals

#ADA

- Technical Momentum Building - Bullish MACD divergence and oversold Bollinger Band position suggest strengthening upward momentum despite current price below moving average

- Support Level Resilience - Successful defense of $0.80 support zone indicates strong buyer interest and establishes foundation for potential upward movement

- Positive Market Narrative - News sentiment highlighting 5% surges, trust restoration, and bullish breakout projections reinforces technical recovery signals

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Signals Despite Current Dip

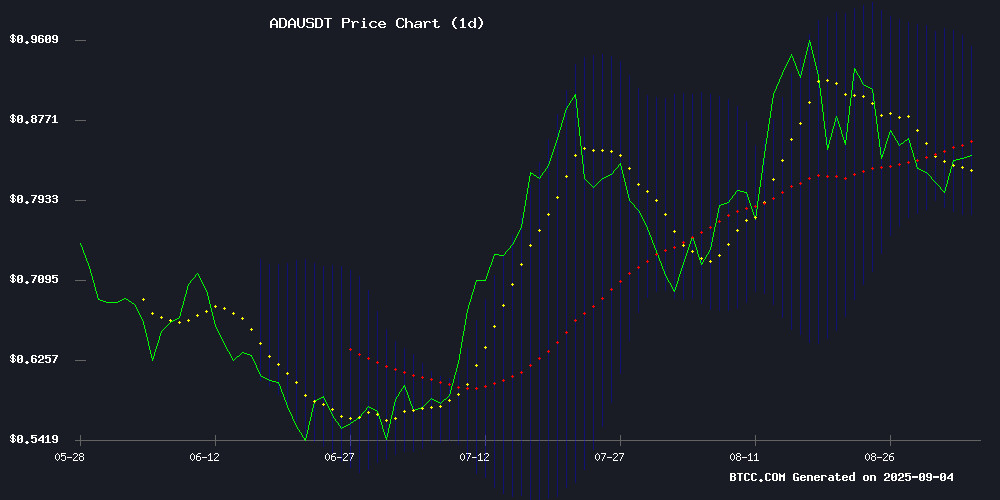

ADA is currently trading at $0.8105, sitting below its 20-day moving average of $0.8648, indicating short-term bearish pressure. However, the MACD indicator shows bullish momentum with the MACD line at 0.0317 above the signal line at 0.0090, generating a positive histogram of 0.0226. The Bollinger Bands position ADA NEAR the lower band at $0.7739, suggesting potential oversold conditions. According to BTCC financial analyst Emma, 'The technical setup suggests ADA is testing crucial support at $0.80 while maintaining bullish divergence on momentum indicators, which could signal an upcoming reversal toward the middle Bollinger Band around $0.8648.'

Market Sentiment: Cardano Builds Bullish Foundation Amid Market Uncertainty

Recent news headlines reflect a cautiously optimistic sentiment for Cardano. Multiple reports highlight ADA's ability to maintain key support levels despite broader market bearishness, with specific mentions of a 5% price surge and successful defense of the $0.80 support zone. The most bullish projection targets $1.05, suggesting growing confidence in ADA's recovery potential. BTCC financial analyst Emma notes, 'The news FLOW aligns with technical observations - while short-term pressure exists, the underlying narrative focuses on Cardano's resilience and potential breakout scenarios. The restoration of trust and consistent support defense indicates building momentum for a potential push toward higher resistance levels.'

Factors Influencing ADA's Price

Cardano (ADA) Poised for Bullish Breakout with $1.05 Target in Sight

Cardano's native token ADA is showing strong technical signals for a potential rally, currently trading around $0.84 with critical moving averages acting as support. Analysts project a 20-25% upside toward $1.05 by October 2025, which would mark one of ADA's most significant moves this year.

Short-term targets hover between $0.92-$0.95 within the next week, representing a 10-13% gain. The $0.95 resistance level—coinciding with the upper Bollinger Band—serves as the key breakout threshold. Should bullish momentum hold, ADA could reach $1.01-$1.05 within four to six weeks. On the flip side, $0.78 remains critical support; a breach could invalidate the optimistic outlook.

Market sentiment varies widely among analysts. While PricePredictions.com eyes an ambitious $2.63 short-term target and CoinMarketCap forecasts $2.47 for 2025, more conservative models remain anchored to fundamental indicators.

Cardano Restores Trust Amid Bearish Market Sentiment

Cardano founder Charles Hoskinson has been exonerated of all allegations following a forensic audit by Input Output (IOHK), restoring confidence in the project. The independent investigation dismissed the charges as baseless, reinforcing Hoskinson's credibility and ADA's position as a leading blockchain.

Despite this positive development, community sentiment toward Cardano has dipped to a five-month low, according to Santiment data. Retail investors appear cautious, even as long-term holders continue accumulating ADA. The token's price defied the bearish mood, rising nearly 5% in a show of resilience.

ADA currently trades at $0.8222 with a $1.4 billion 24-hour volume, reflecting a 1.62% decline. The divergence between price action and sentiment suggests underlying strength, with the market capitalization holding at $29.28 billion.

Cardano Price Prediction: ADA Flashes Buy Signal as Bulls Defend $0.80 Support Zone

Cardano has emerged as a standout performer in the altcoin market, defying the sideways trend that has constrained its peers. ADA's price action suggests growing investor confidence, with the token now testing critical support levels that could determine its near-term trajectory.

Over the past 90 days, Cardano has quietly outperformed major cryptocurrencies, posting gains of nearly 25%. This sustained rally—unlike the speculative surges seen in meme tokens—points to organic demand building beneath the surface. The token's ability to outpace established altcoins like SUI and TRX underscores its evolving market position.

Technical analysis reveals ADA hovering around $0.84, with bulls successfully defending the $0.68-$0.70 support zone on monthly charts. This price floor has historically triggered reversals, making its current defense particularly significant for traders.

Cardano Defies Bearish Sentiment with 5% Price Surge

Cardano's retail traders have turned bearish, marking the lowest sentiment levels in five months. Paradoxically, ADA's price has climbed 5% amid this negativity—a classic case of 'weak hands' capitulation creating accumulation opportunities for strategic players.

Market analysts observe a recurring pattern: when impatient traders exit positions, institutional investors and high-net-worth individuals quietly build stakes. The current divergence between price action and sentiment suggests ADA may be primed for further upside as selling pressure from retail diminishes.

Cardano Holds Key Support Amid Neutral Technical Signals

Cardano's ADA trades at $0.82, down 1.61% in the past 24 hours, as technical indicators paint a neutral picture. The Relative Strength Index at 46.81 suggests balanced momentum, leaving room for potential moves in either direction.

Binance spot volume reached $67.2 million, demonstrating sustained interest despite the absence of major fundamental catalysts. Market participants now focus on technical levels, with $0.82 emerging as critical support for any recovery attempt.

Will ADA Price Hit 1?

Based on current technical indicators and market sentiment, ADA shows promising signs for eventually reaching $1, though immediate breakthrough appears challenging. The price currently trades at $0.8105, requiring approximately 23% upside to reach the $1 target.

| Indicator | Current Value | Bullish Signal |

|---|---|---|

| Price vs 20-day MA | $0.8105 / $0.8648 | Below MA (Bearish Short-term) |

| MACD Histogram | +0.0226 | Bullish Momentum |

| Bollinger Position | Near Lower Band | Potential Oversold |

| Key Support | $0.80 | Successfully Defended |

BTCC financial analyst Emma suggests: 'The combination of bullish MACD momentum, successful support defense at $0.80, and positive news sentiment creates a foundation for gradual recovery. While $1 represents significant resistance, the technical setup and market narrative support a measured upward trajectory, potentially reaching this level if broader market conditions improve and buying pressure sustains.'